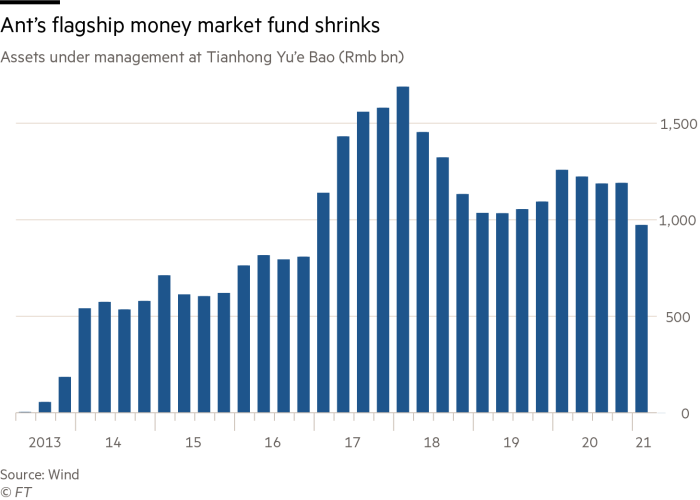

Ant Group’s money market fund has shrunk to a more than four-year low as users shifted their cash in the face of China’s crackdown on Jack Ma’s payments group.

Funds invested in Ant’s flagship Yu’e Bao fund fell 18 per cent in the first three months of the year to Rmb972bn ($150bn) as the group pushed users to switch to other providers’ funds, according to data released on Thursday by its Tianhong Asset Management subsidiary. The money-market fund, once the world’s largest, acts as the main repository for leftover cash stored by hundreds of millions of users of Ant’s Alipay payments app.

The fall came as Chinese authorities have piled pressure on Ma’s internet empire since abruptly halting Ant’s $37bn initial public offering, which would have been the world’s largest, in November. Ma has barely been seen in public since the listing was scuppered and regulators fined Alibaba, Ant’s ecommerce sister group, a record $2.8bn for anti-competitive behaviour this month.

Ant was ordered to “actively reduce” Yu’e Bao’s size as part of a restructuring deal struck with Chinese authorities last week. Regulators have long been concerned about Yu’e Bao’s immense size, fearing a spate of redemptions could cause systemic financial risks.

Li Huang, an analyst at Fitch Ratings, said the fall marked the largest percentage decline in Yu’e Bao’s history, adding: “We expect [its] size to further decline in the coming quarters, but maybe at a slower pace.”

The flagship money market fund is managed by Tianhong and reported 690m investors at the end of 2020.

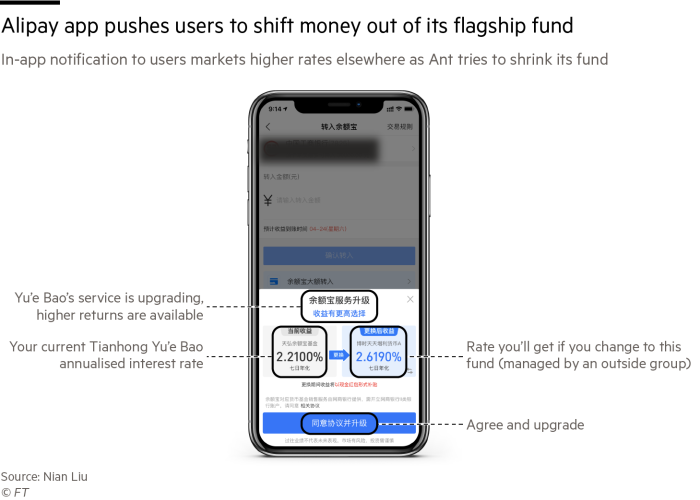

Alipay users said they had recently received notifications encouraging them to shift their savings elsewhere.

Constance Zhou, a 28-year-old law firm employee, said she transferred Rmb100,000 at the end of January after receiving an in-app notification that highlighted higher interest rates with another fund. “I looked at the difference and just transferred it out,” she said, adding that banks’ investment products offered better interest rates than Alipay.

Yu’e Bao offered annual interest rates of more than 6 per cent when it was launched in 2013 by investing in assets including bonds. But returns have fallen to closer to 2 per cent in recent months as the fund has prioritised safer, more liquid assets such as bank deposits, and as interest rates fell more broadly.

Kevin Kwek, an analyst at Bernstein Research, said Yu’e Bao incentivised users to keep returning to the app so a “forced reduction” reduced its attractiveness.

Ant had already been shifting away from marketing its own financial products towards serving as a platform for other groups to access its huge customer base. The Yu’e Bao platform markets more than two dozen money market funds from third-party asset managers.

Yu’e Bao is part of Ant’s investment business, which brought in Rmb11bn in revenue in the first six months of last year, or 16 per cent of the group’s total.

Tianhong called the drop in assets “within the normal range” and said similar fluctuations in Yu’e Bao’s size had occurred previously. It added that the fund was “operating stably, and the decline in scale is not necessarily related to the fund’s operational risk”.

Additional reporting by Nian Liu and Sherry Fei Ju in Beijing