Deutsche Bank AG’s operations in the Americas, particularly in the U.S., are expected to continue on an upward trajectory in the year ahead, even as markets normalize and political and regulatory scrutiny persists, analysts said.

The German lender is in the midst of a massive restructuring that seeks to scale back low-performing businesses and locations. The U.S. unit had underperformed in previous years due to a lack of focus but remains an “indispensable” part of the group, Christiana Riley, CEO for the Americas, said in January 2020.

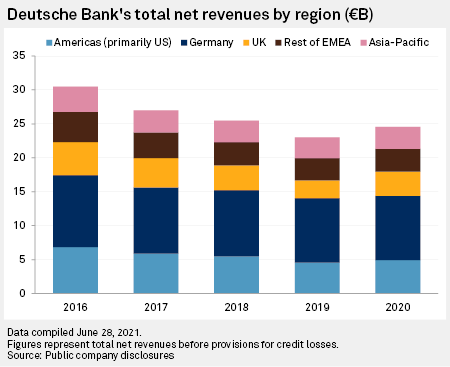

More than two years into group CEO Christian Sewing’s overhaul, the Americas’ performance has started to recover. Deutsche Bank’s total net revenue from the Americas rose to €4.93 billion in 2020 from €4.55 billion the year before, according to S&P Global Market Intelligence data. The year-over-year growth reversed three years of consecutive decline since 2016, when the region booked €6.83 billion of revenue.

“We have exited unprofitable businesses, reduced our client perimeter to be focused on client relationships rather than league tables, and we no longer take outsize risk. This has resulted [in] exactly what we intended: increased stability and predictability of our returns,” Riley said in a virtual investor presentation in December 2020.

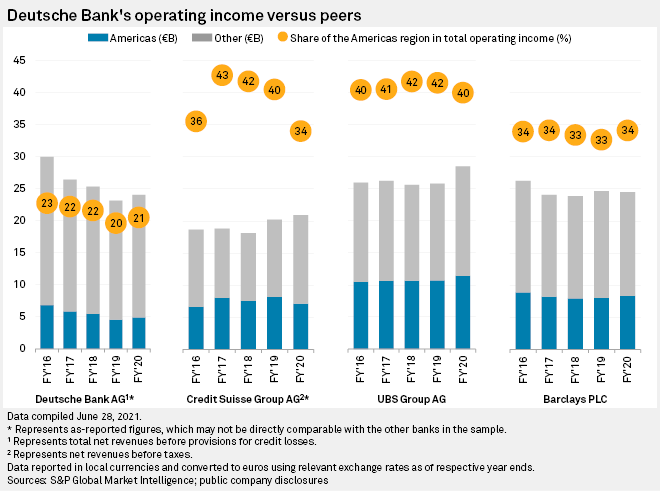

The region contributed 21% of the group’s operating income in 2020, up from 20% in 2019. However, this still lags its European peers: Swiss bank UBS Group AG generated 40% of its operating income in 2020 from the Americas, and Barclays PLC and Credit Suisse Group AG both recorded 34% of operating profit in the region.

The Americas is the second-largest source of revenue for Deutsche Bank after Germany. Most of the turnover is generated in the U.S. investment bank, which accounted for 60% of regional revenue in the first nine months of 2020, according to Riley.

“The evolution in the investment banking platform in the Americas over the past 18 months has been remarkable. It has given us a strong platform and … we are seeing a resurgence of client engagement as a result,” Riley said during the presentation.

The pursuit of stability

An expected slowdown in trading in the latter half of 2021 as economies gradually recover from a coronavirus-induced downturn has spurred concerns over Deutsche Bank’s ability to maintain its investment bank’s strong performance. Analysts at CFRA have warned that the bank faces a tough revenue outlook this year amid the normalization of trading and subdued economic activity as well as the impact of lower-for-longer interest rates.

With the Americas business largely relying on the investment bank in the U.S., any slowdown in fixed income and foreign exchange activities would also weaken the region’s earnings, according to Giles Edwards, S&P Global Ratings’ sector lead for European financial institutions. A key area to look out for is if the bank can deliver the business stability and competitive position it has lacked for some years by boosting revenues in private and corporate banks, outside of the investment bank, he added.

|

Christiana Riley, Deutsche Bank’s CEO for the Americas, speaks during a press conference for the bank’s 2019 annual results. |

According to Riley, the region expects to see higher global financial demand post-COVID-19 “as corporates reestablish themselves and renew their investment programs.” There has been increasing demand for green and sustainable finance, especially in the U.S., where the Biden administration has made sustainability one of its key priorities.

“We also expect revenue growth from our controlled expansion in credit to new clients in focused sectors, in particular in [the] healthcare, industrials, consumer and the technology, media and telecom sectors,” the executive said.

Christian van Beek, director for financial institutions at Scope Ratings, said the execution of the group’s strategy in the U.S. so far “points to a more stable regional performance and thus less dependent on markets sentiment.”

“Focusing on areas of strength appears to be a viable strategy” for the bank, especially given the strength of its peers in the U.S., according to Sonja Förster, vice president for credit ratings at DBRS Morningstar, but exiting risky businesses such as prime finance would also cut the likelihood of outsized losses.

Förster added that, “overall, the bank needs financial flexibility in order to take advantage of growth opportunities, and we note that the recent increase in capital ratios has allowed the bank to grow its balance sheet and take on more risk. However, given the limited profitability compared to U.S. peers, growth will remain somewhat constrained in our view.”

Beware the watchdog

Deutsche Bank’s U.S. operations are not without their troubles. The bank’s business ties with former President Donald Trump are part of a congressional investigation and, more recently, the Federal Reserve reportedly warned of potential fines if it does not improve its anti-money laundering shortcomings. The bank has since said it would reorganize its structure in order to boost its anti-financial crime efforts.

While Deutsche Bank has put “too little focus in the past” on its anti-financial crime controls and needs to address this area “more forcefully,” this is not expected to significantly harm performance in the region, according to Förster. The regulatory matters in the U.S. “are really not so different to those in Europe,” Edwards added.

Bold ambitions

Riley said in her presentation that the region will seek to cut infrastructure costs while maintaining investments in technology and controls and continuing to foster the investment bank. She added that it expects to make significant cost savings through automation.

The region’s investment bank has exceeded the group return on tangible equity two years ahead of schedule, Riley said, adding that a ROTE of about 11% is expected in what will probably be “more normalized times” in 2022.

“[Our] story is not about shrinking,” said Riley. “On the contrary, our business in the region, now properly focused, has a clear growth trajectory.”