Companies in the home improvement products space like Lowe’s Companies, Inc. LOW have been gaining from consumers’ inclination toward home renovation and maintenance. Experts believe that last year’s prolonged stay-at-home norms made people realize the importance of their shelters. Consumers’ spending on homes have continued, even as outdoor movement gathers pace, as interests of keeping houses well maintained are here to stay. Backed by favorable demand trends, Lowe’s has been witnessing strong growth in its Pro business and online platform. Also, the Total Home strategy has been gaining traction and helping meet consumers’ needs across categories.

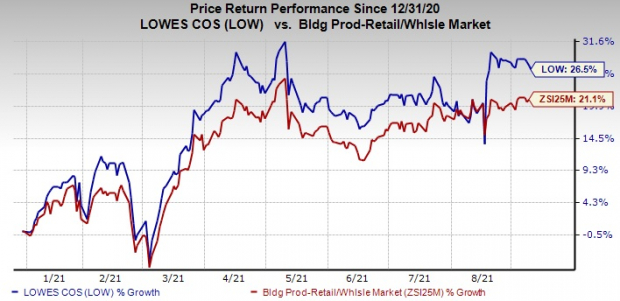

This Zacks Rank #3 (Buy) company’s shares have gained 26.5% in the year-to-date period compared with the industry’s rise of 21.1%. Let’s take a closer look at the aspects aiding the performance of this renowned home-improvement retailer.

Solid Online Sales is an Upside

Lowe’s online platform has been acting as a feather on its cap. Online sales have been gathering pace owing to consumers’ growing preference for digital shopping and the company’s efficient omni-channel offerings. Markedly, sales in Lowes.com increased 7% in second-quarter fiscal 2021.

Lowe’s has been investing toward enhancing its omni-channel retailing capabilities in store operations, website and supply chain, to resonate well with customers’ demand. In this context, the company completed the installation of Buy Online Pickup in Store touchless lockers across its stores. The company is also striving to enhance customers’ online shopping experience by improving features like search and checkout. Going ahead, management believes that its online business model has tremendous potential to grow, backed by an efficient technology team and superior cloud-based platform.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Focus on Pro Customers Bodes Well

Pro customers have been a significant driver in Lowe’s business growth. In fact, continued focus on the Pro category is a very significant component of the Total Home strategy. During the fiscal second quarter, the company’ Pro sales increased 21%. To continue generating sales from pro customers, the company has been augmenting pro-focused brands. Prudent partnerships are helping the company to provide pro customers with a broad range of assortments that suit their specific home improvement and maintenance needs. Lowe’s has refurbished its pro-service business website, LowesForPros.com. to meet the special needs of Pro-customers. Management is focused on boosting greater Pro penetration via the Pro Customer Relationship Management or CRM tool.

Home Improvements Market Holds Potential

Consumers have been investing in making homes well equipped for work-from-home and entertainment needs amid the pandemic. Lowe’s continues to cater to consumers’ requirements for remodeling, space-conversion projects as well as core repair and maintenance activity. Lowe’s is also gaining traction with the newly-introduced Total Home strategy that includes providing complete solutions for various types of home repair and improvements needs. The total home strategy is expected to boost market share by accelerating investments in pro-related offerings, installation services, localization as well as boosting product assortments.

During the fiscal second quarter, the U.S. comparable sales were up 32% on a two-year stacked basis. This reflects on the consistent success of the company’s Total Home strategy. During the second quarter, the company saw 21% growth in Pro, 10% growth in Installation Services and strong comparable sales across the Decor product categories. It delivered strong comps across the kitchen and bath, flooring, appliances and decor on top of 20% increase in these categories in the year-ago period.

Wrapping Up

Solid execution of growth strategies along with compelling product offering of well-known brands and high-value private labels has been helping Lowe’s efficiently meet high demand for home-improvement products. Management believes that the home improvement market has robust growth potency, with consumers becoming highly motivated to invest in homes and continuation of urbanization trends. Backed by such upsides, the company expects revenues of nearly $92 billion for fiscal 2021, indicating growth of 2.7% year over year.

3 Picks You Can’t Miss Out On

Tecnoglass Inc. TGLS, flaunting a Zacks Rank #1 (Strong Buy), has a long-term earnings growth rate of 20%. You can see the complete list of today’s Zacks #1 Rank stocks here.

GMS Inc. GMS, also sporting a Zacks Rank #1, delivered an earnings surprise of 19.5% in the last four quarters, on average.

Costco Wholesale Corporation COST with a Zacks Rank #2 (Buy), has a long-term earnings growth rate of 9.3%.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 Crypto-Related Stocks Now >>

Lowes Companies, Inc. (LOW): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

Tecnoglass Inc. (TGLS): Free Stock Analysis Report

GMS Inc. (GMS): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.