4 min read

This story originally appeared on Zacks

Virtu Financial, Inc. VIRT has been under pressure this year so far as investors grew bearish on the stock due to reduced market volatility that has weighed on its trading volumes.

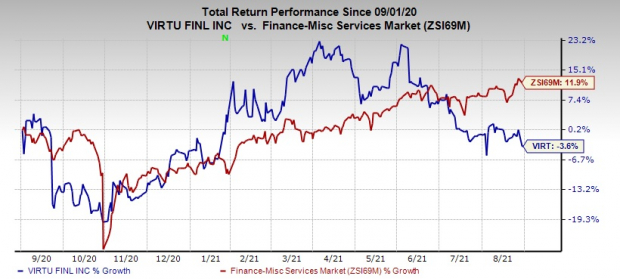

In the past year, the company has lost 3.6% against its industry’s growth of 11.9%.

Image Source: Zacks Investment Research

Estimates Turn Downbeat

As analysts are not sanguine about the stock’s prospects, they downgraded both 2021 and 2022 earnings estimates.

Over the past 30 days, the company has witnessed its current and next-year earnings estimates move 4.8% and 3.4% south, respectively.

Its second-quarter 2021 earnings per share of 63 cents missed the Zacks Consensus Estimate of 75 cents by 16% due to lower revenues. The bottom line also decreased 63.4% year over year.

The company witnessed muted activity and soft market volumes in the second quarter.

Operating revenues of $342 million declined 48.9% year over year due to weak trading volume in U.S. equities.

What’s Bothering the Stock?

The financial services provider gains traction from market volatility and evidently, the ongoing coronavirus pandemic has immensely boosted its performance so far. Despite the fact that market volatility still remains above the 2019 levels, it stabilized from the first-half 2020 uncertainty. While most companies suffered a setback from the prevalent pandemic crisis, Virtu Financial earned a sweet spot following turbulence in the market.

However, Virtu Financial’s performance is taking a hit from low market volumes as the economy started recovering to a certain extent. Decline in market volatility causes an uninterrupted financial market, resulting in reduced demand for liquidity, and lesser trading and profit opportunities for Virtu Financial.

Moreover, escalating expenses have been weighing down margins for many quarters now. In 2019 and 2020, the same rose 29.2% and 13.7% year over year, respectively, due to higher brokerage, exchange, clearance fees and payments for order flow, net, communication and data processing, etc. Although the same recovered to some extent in the first six months of 2021, we think the metric is going to bother in the future again, weighing on the company’s margins.

As the market volatility is decreasing, the Marketing Making segment is facing market volume weakness. Revenues from this segment plunged 48.9% in the first half of 2021. Given the current situation, we expect the segment to continue witnessing poor volumes as the market is resuming normalcy.

Nevertheless, Virtu Financial might continue to gain from the market volatility as compared to previous figures as the economy has still not fully recovered from pandemic-related blows. It is also consistently benefiting from its Execution Services segment on the back of commissions, workflow technology and analytics. We expect the segment to carry on with its encouraging performance given the current market scenario.

However, depressed trading volumes might put earnings under pressure, which in turn, could drag the stock.

Thus, until the company’s business volumes gain strength, we should steer clear of the stock.

It currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks to Consider

Some better-ranked stocks in the same space are HoulihanLokey, Inc. HLI, XP Inc. XP and Equitable Holdings, Inc. EQH, each holding a Zacks Rank #2 (Buy) at present.

Earnings of HoulihanLokey, XP and Equitable Holdings delivered a trailing four-quarter surprise of 38.3%, 24.4% and 15.9%, respectively, on average.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Virtu Financial, Inc. (VIRT): Free Stock Analysis Report

Houlihan Lokey, Inc. (HLI): Free Stock Analysis Report

Equitable Holdings, Inc. (EQH): Free Stock Analysis Report

XP Inc. (XP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research